Buying cryptocurrency using credit cards has become increasingly popular, offering a convenient alternative to traditional payment methods. This guide dives deep into the process, examining various platforms, associated fees, security measures, and crucial considerations for a smooth and secure transaction.

From understanding the different cryptocurrencies available to comparing various payment methods, this comprehensive overview equips you with the knowledge needed to make informed decisions about buying crypto with your credit card.

Introduction to Buying Crypto with Credit Cards

Buying cryptocurrencies using credit cards has become increasingly popular, offering a convenient way to access the digital asset market. This method simplifies the process for those unfamiliar with traditional cryptocurrency exchanges or bank transfers. However, it’s crucial to understand the associated procedures, potential fees, and security considerations before engaging in such transactions.The process typically involves selecting a platform, inputting credit card details, and confirming the cryptocurrency purchase.

Different platforms may offer varying features and support diverse cryptocurrencies, each with its own set of benefits and drawbacks. Understanding the nuances of these platforms and their accompanying fees is essential for making informed decisions.

Available Platforms and Services

Various platforms facilitate the purchase of cryptocurrencies using credit cards. These include dedicated cryptocurrency exchanges, some brokerage platforms, and even some fintech companies. Each platform often has its own set of terms and conditions, which users should carefully review before initiating a transaction. These platforms may vary in the types of cryptocurrencies supported, the transaction fees, and the overall user experience.

Fees and Charges

Transaction fees associated with purchasing cryptocurrencies using credit cards can vary significantly depending on the platform. These fees are typically structured in two main components: the platform’s transaction fee and the credit card network fee. The platform’s fee is charged by the exchange or broker, while the credit card network fee is charged by the credit card provider.

It’s vital to compare these fees across different platforms to identify the most cost-effective option.

Security Measures

Security is paramount when dealing with financial transactions, especially when purchasing cryptocurrencies. Reputable platforms typically employ robust security measures, including two-factor authentication, encryption protocols, and fraud detection systems. Users should prioritize platforms with a strong track record of security and transparency in their security protocols. This includes verifying the platform’s security certifications and reading reviews from other users.

Comparison of Platforms for Buying Crypto with Credit Cards

| Platform |

Fees (Example) |

Security Measures |

User Experience |

| Crypto.com |

0.5% + 2% (credit card network fee) |

Two-factor authentication, advanced encryption, regular security audits |

Intuitive interface, good customer support |

| Coinbase |

1% + 2% (credit card network fee) |

Multi-factor authentication, security protocols, user monitoring |

Widely used, user-friendly interface |

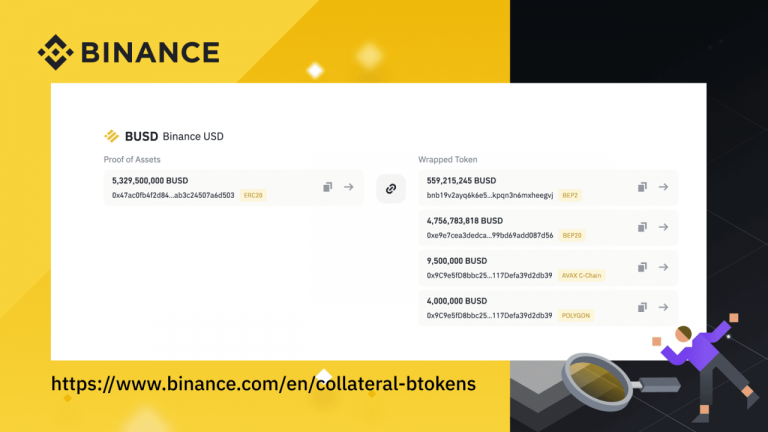

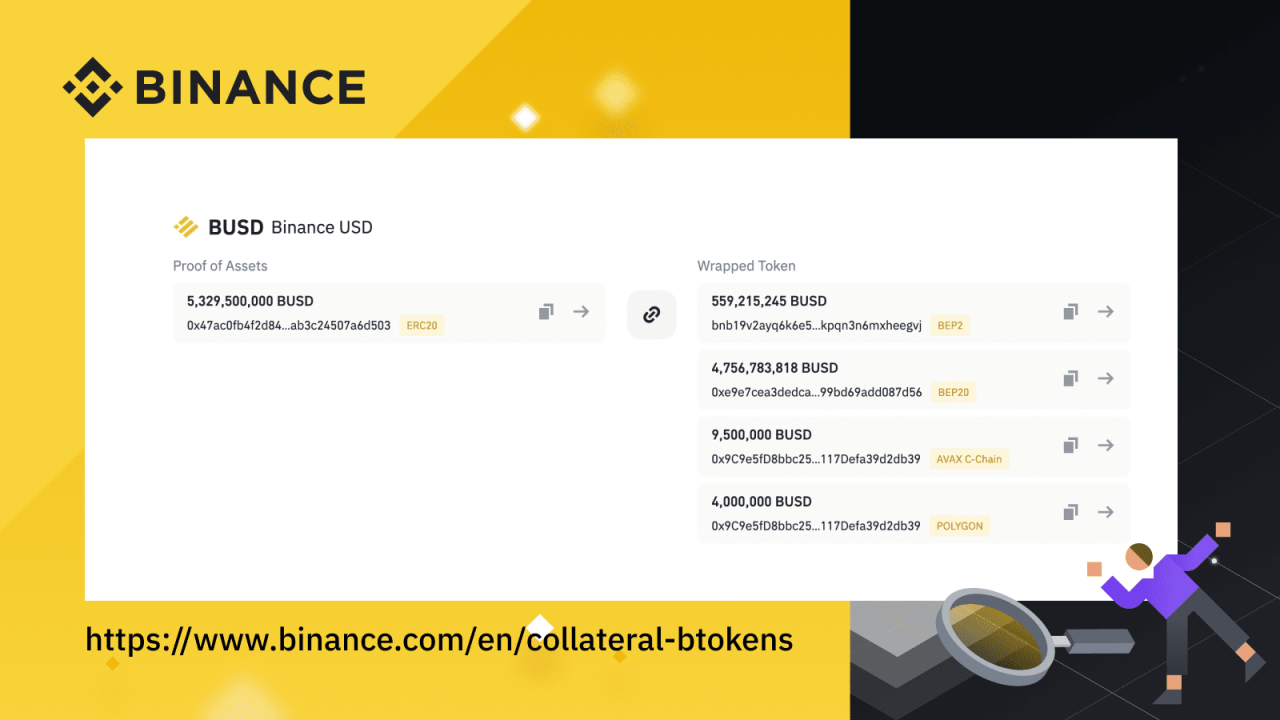

| Binance |

0.5% + 2% (credit card network fee) |

Advanced encryption, multi-factor authentication, fraud detection |

Extensive range of cryptocurrencies, potentially complex interface |

This table provides a basic comparison. Fees and security measures can change over time, so users should always refer to the latest information on the respective platform’s website. The user experience is subjective and may vary depending on individual needs and preferences.

Pros and Cons of Using Credit Cards for Crypto Purchases

Using credit cards for crypto purchases is a convenient option for many, but it’s crucial to understand the potential benefits and drawbacks before making a transaction. This approach can streamline the process, but it also comes with risks. Understanding these aspects is vital for making informed decisions.

Advantages of Using Credit Cards for Crypto Purchases

Credit cards offer a convenient way to buy crypto without needing a bank account or transferring funds. The ability to use a familiar payment method, often with readily available rewards programs, can be an attractive proposition for some users. This streamlined approach can reduce the steps involved in acquiring crypto compared to other methods, which can be particularly appealing to beginners.

For instance, if a user is already comfortable with using their credit card for everyday purchases, they can readily apply this knowledge to buying crypto.

Disadvantages of Using Credit Cards for Crypto Purchases

Using credit cards for crypto purchases can come with significant disadvantages. One major concern is the potential for high interest charges if the balance isn’t paid in full. Credit card interest rates can be substantial, and accumulating debt on a crypto purchase can lead to significant financial strain. Furthermore, crypto volatility can lead to losses if the price drops before the balance is paid.

This risk is heightened because the credit card issuer may not have a clear understanding of crypto’s price fluctuations. For instance, a user might buy crypto at a high price and then see the price drop before they can repay their credit card debt.

Comparison with Other Payment Methods

Several alternative payment methods exist for purchasing crypto. Debit cards offer a similar convenience to credit cards but often have transaction limits. Bank transfers, while secure, can be slower and involve additional steps. Direct exchange platforms may offer better pricing but often require account registration and verification. The choice depends on individual needs and preferences.

A comparison across cost, security, and convenience can help users determine the best method.

Potential Risks Associated with Using Credit Cards for Crypto Transactions

Several potential risks are associated with using credit cards for crypto purchases. High interest rates, coupled with crypto market volatility, can lead to substantial financial losses if the price of the crypto drops. Security breaches related to credit card information are another concern, though this is mitigated by using reputable platforms. Moreover, unexpected fees, such as foreign transaction fees or late payment charges, can add to the financial burden.

It’s important to review the terms and conditions of both the credit card and the crypto exchange.

Comparison Table: Credit Cards, Debit Cards, and Bank Transfers for Crypto Purchases

| Payment Method |

Cost |

Security |

Convenience |

| Credit Card |

Potentially high interest rates, possible foreign transaction fees |

Generally secure when using reputable platforms, but risk of credit card fraud exists |

High convenience, readily available and familiar |

| Debit Card |

Transaction limits, potential fees |

Generally secure, but transaction limits can be restrictive |

Moderate convenience, similar to credit cards |

| Bank Transfer |

Low or no fees |

Generally secure, but slower transaction time |

Low convenience, requires more steps and time |

Security Considerations

Using credit cards for cryptocurrency purchases presents unique security challenges. While convenient, it’s crucial to understand the potential risks and adopt robust security measures to protect your financial information and cryptocurrency holdings. A proactive approach to security is essential to mitigate the dangers associated with online transactions, especially those involving digital assets.

Potential Security Threats

Several threats lurk when using credit cards for cryptocurrency purchases. Phishing scams, where malicious actors impersonate legitimate entities to steal personal information, are a significant concern. Malicious websites designed to mimic legitimate crypto exchanges can also trap unsuspecting users. Furthermore, compromised credit card details or insecure platforms can lead to unauthorized transactions and financial losses. Weak security protocols on the platform or exchange itself can expose user data, making them vulnerable to attacks.

Protecting Yourself from Fraud and Scams

Implementing robust security measures can significantly reduce the risk of fraud and scams. Verifying the legitimacy of a crypto exchange is paramount. Look for secure connections (indicated by “https” in the website address) and examine user reviews and reputable sources. Never share sensitive information (like credit card details or passwords) via unsolicited emails or messages. Implement strong passwords, incorporating a mix of uppercase and lowercase letters, numbers, and symbols.

Employing two-factor authentication (2FA) adds an extra layer of security, requiring a code from a separate device to verify logins.

Secure Practices for Crypto Transactions

Employing secure practices is vital to safeguard your transactions. Always use a reputable and well-reviewed crypto exchange or platform. Avoid using public Wi-Fi networks for sensitive transactions. If you must use a public network, consider a virtual private network (VPN) to encrypt your connection. Regularly monitor your credit card and cryptocurrency account statements for any unauthorized activity.

Report any suspicious activity immediately to the respective institutions.

Verifying the Legitimacy of a Crypto Exchange

To ensure the legitimacy of a crypto exchange, research its reputation thoroughly. Check for user reviews on reputable websites and forums. Scrutinize the exchange’s security measures, including encryption protocols and 2FA options. Look for licenses or regulatory approvals from financial authorities, which often indicate a higher degree of trustworthiness. Avoid exchanges with overly aggressive marketing or those offering unusually high returns.

Research the exchange’s history and community engagement.

Security Measures for Online Crypto Purchases

Robust security measures are crucial for safeguarding your online crypto purchases. A comprehensive approach includes various components.

| Security Measure |

Description |

| Two-Factor Authentication (2FA) |

Adding a second layer of security, requiring a code from a separate device to verify logins. This significantly reduces the risk of unauthorized access. |

| Strong Passwords |

Employing complex passwords with a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable passwords. |

| Secure Networks |

Using encrypted connections (HTTPS) and avoiding public Wi-Fi for sensitive transactions. Using a VPN adds an extra layer of security. |

| Regular Account Monitoring |

Actively checking your account statements for any unauthorized activity and promptly reporting any suspicious transactions. |

Different Cryptocurrencies

Purchasing crypto with credit cards opens doors to a wide range of digital assets. Understanding the nuances of these various cryptocurrencies is crucial for informed investment decisions. Different cryptocurrencies cater to diverse needs and offer varying degrees of risk and potential reward.

Cryptocurrencies Available for Purchase

A range of cryptocurrencies are available for purchase using credit cards. This includes popular options like Bitcoin, Ethereum, Litecoin, and others. These options reflect the diversity within the cryptocurrency market.

- Bitcoin (BTC): Widely recognized as the pioneering cryptocurrency, Bitcoin is known for its decentralized nature and limited supply. Its history demonstrates significant price fluctuations, impacting its value.

- Ethereum (ETH): Ethereum serves as a platform for decentralized applications (dApps) and smart contracts. Its broader utility and growing ecosystem contribute to its potential. The evolution of its technology has been a key factor in its market position.

- Litecoin (LTC): This cryptocurrency shares some similarities with Bitcoin but aims to improve transaction speed. Its focus on faster transactions distinguishes it from Bitcoin. The history of Litecoin’s performance relative to Bitcoin is notable.

- Tether (USDT): This cryptocurrency is pegged to the US dollar, offering a stable alternative for those seeking a less volatile investment.

- Binance Coin (BNB): BNB is the native cryptocurrency of the Binance exchange. Its use within the Binance ecosystem and trading activities makes it significant.

Cryptocurrency Differences

Cryptocurrencies differ significantly in their underlying technology, intended use cases, and community support. These factors influence their performance and market positioning. Each cryptocurrency’s unique design influences its potential for future growth.

- Decentralization: Some cryptocurrencies are more decentralized than others, meaning they are less susceptible to control by any single entity. The level of decentralization is a significant aspect of a cryptocurrency’s design and operations.

- Functionality: Beyond being a form of currency, some cryptocurrencies act as platforms for decentralized applications (dApps) or smart contracts. The functions of these cryptocurrencies are diverse and reflect the varied needs of the market.

- Security: Security measures and protocols vary among cryptocurrencies, impacting their resilience to attacks and vulnerabilities. The security features of each cryptocurrency influence the safety of user investments.

Volatility and Risk

Cryptocurrencies are known for their price volatility. This inherent risk must be considered alongside potential rewards. The history of cryptocurrencies showcases significant price fluctuations, demonstrating the importance of understanding market trends.

- Bitcoin Volatility: Bitcoin’s price fluctuations have been dramatic, with periods of significant gains and losses. Understanding these trends and factors contributing to them is vital for any investor.

- Ethereum Price Swings: Ethereum’s price movements are often tied to the development of new applications and the adoption of its platform. Understanding the evolution of the platform and its adoption rate is crucial for evaluating its risk.

Market Comparison

The market capitalization and trading volume of cryptocurrencies offer insights into their popularity and liquidity. A higher market capitalization usually indicates greater investor confidence.

| Cryptocurrency |

Market Cap (USD) |

Trading Volume (USD) |

Volatility (Historical Data) |

| Bitcoin (BTC) |

(Example Value) |

(Example Value) |

(Example Value – High) |

| Ethereum (ETH) |

(Example Value) |

(Example Value) |

(Example Value – Medium) |

| Litecoin (LTC) |

(Example Value) |

(Example Value) |

(Example Value – Low) |

| Tether (USDT) |

(Example Value) |

(Example Value) |

(Example Value – Low) |

| Binance Coin (BNB) |

(Example Value) |

(Example Value) |

(Example Value – Medium) |

Note: Example values are placeholders and should be replaced with actual data from reliable sources. Volatility is a complex metric and can be measured using various indicators.

Buying Bitcoin with Credit Cards

Purchasing Bitcoin using credit cards is a common method, but it’s crucial to understand the intricacies involved, including the steps, fees, and security precautions. This process, while convenient, carries risks that need careful consideration.

The Bitcoin Purchase Process

Bitcoin purchases through credit cards typically involve a third-party platform acting as an intermediary. These platforms facilitate the transaction, converting your credit card payment into Bitcoin. The process generally involves authorizing the payment through your credit card provider and then confirming the Bitcoin transfer on the platform.

Steps Involved in Bitcoin Purchases

Understanding the steps involved in buying Bitcoin on various platforms is essential. These platforms often have unique interfaces and procedures. A general overview can help you navigate the process effectively.

- Platform Selection: Choosing a reputable platform is paramount. Research platforms’ security measures, transaction fees, and user reviews. Factors like ease of use, customer support, and available payment options are also vital.

- Account Creation: Creating an account on the chosen platform often involves providing personal information and verifying your identity. This is a standard security procedure across many online services.

- Fund Deposit: Linking your credit card to the platform’s payment system allows you to deposit funds. Review the platform’s deposit limits and any associated fees.

- Bitcoin Purchase: Input the desired Bitcoin amount you wish to purchase. The platform will display the equivalent fiat currency (e.g., USD, EUR) for the selected Bitcoin amount. Confirm the transaction details.

- Transaction Confirmation: The final step involves confirming the Bitcoin purchase on the platform. Verify all details and ensure you’ve correctly authorized the transaction.

Fees and Charges

Transaction fees associated with Bitcoin purchases using credit cards vary significantly between platforms. These fees often include platform fees, network fees, and potentially currency conversion charges. It’s crucial to understand these charges before proceeding with a purchase.

| Fee Type |

Description |

Example |

| Platform Fee |

A fee charged by the platform for facilitating the transaction. |

1% of the transaction amount. |

| Network Fee |

A fee paid to the Bitcoin network for processing the transaction. |

$0.001 per transaction. |

| Currency Conversion Fee |

A fee associated with converting fiat currency to Bitcoin. |

0.5% of the transaction amount. |

Security Considerations

Security is paramount when purchasing Bitcoin with credit cards. Choose platforms with robust security measures, like two-factor authentication (2FA), and avoid platforms with questionable security practices. Be wary of phishing scams or fraudulent websites.

“Protecting your financial information is critical when engaging in online transactions. Be cautious and verify the platform’s legitimacy before providing any sensitive data.”

Step-by-Step Guide for Buying Bitcoin with Credit Card

This guide Artikels the process for purchasing Bitcoin with a credit card, focusing on general steps. Platform-specific procedures might vary.

- Research and Select a Platform: Thoroughly research and compare various Bitcoin trading platforms based on security, fees, and user reviews. Choose a platform with a strong reputation.

- Create an Account: Complete the platform’s account creation process, providing accurate and necessary information, and verify your identity as required.

- Add Payment Method: Link your credit card to the platform’s payment system. Carefully review any associated fees.

- Specify Bitcoin Amount: Enter the amount of Bitcoin you wish to purchase. The platform will show the equivalent fiat currency amount.

- Confirm the Transaction: Double-check all details (amount, fees, etc.) before confirming the purchase. Never proceed without thorough verification.

- Monitor the Transaction: Keep an eye on the transaction status to ensure a successful completion. If any issues arise, contact the platform’s support team.

Regulatory Landscape and Legal Considerations

The regulatory environment surrounding cryptocurrency purchases, particularly those facilitated by credit cards, is complex and varies significantly across jurisdictions. This dynamic landscape presents both opportunities and challenges for both consumers and platforms. Understanding the legal implications and compliance requirements is crucial for safe and responsible participation in the cryptocurrency market.The legal frameworks governing cryptocurrencies are still evolving. This often leads to uncertainty regarding the legality of specific transactions, including those involving credit cards.

Furthermore, the decentralized nature of cryptocurrencies can complicate enforcement efforts, creating additional legal hurdles.

Regulatory Environment Overview

Different countries and regions have adopted varying approaches to regulating cryptocurrencies. Some have embraced cryptocurrencies, while others have imposed strict restrictions. These diverse regulatory environments significantly impact the availability and accessibility of cryptocurrency services and products, particularly when using credit cards.

Legal Implications and Restrictions

Numerous legal implications and restrictions influence the use of credit cards for crypto purchases. For instance, some jurisdictions classify cryptocurrencies as securities, commodities, or other financial instruments, thereby triggering specific regulatory requirements. This classification impacts the way crypto exchanges and payment processors operate, influencing their compliance obligations and potentially affecting the availability of credit card services for crypto purchases.

Furthermore, anti-money laundering (AML) and know-your-customer (KYC) regulations are often in place, imposing requirements on platforms facilitating crypto transactions to verify user identities and prevent illicit activities.

Compliance Requirements for Platforms

Platforms facilitating crypto purchases using credit cards face significant compliance requirements. These requirements often include robust KYC procedures, AML compliance protocols, and adherence to regulations governing financial instruments. Failure to meet these requirements can result in substantial penalties, including fines and legal action. These compliance measures are designed to protect both consumers and the financial system from fraud and illicit activities.

Potential Legal Issues Associated with Crypto Purchases

Potential legal issues associated with crypto purchases using credit cards include disputes over transaction validity, fraud, and money laundering. Consumers should exercise caution and ensure they are transacting on regulated platforms. Platforms should prioritize robust security measures and transparent policies to mitigate the risk of such legal issues.

Summary Table of Legal and Regulatory Considerations

| Region |

Regulation on Crypto |

Regulation on Credit Card Use for Crypto |

Potential Legal Issues |

| United States |

Varying by state and federal agency interpretations |

Subject to evolving regulatory scrutiny |

Fraudulent activity, non-compliance with KYC/AML |

| European Union |

Generally, cryptocurrencies are treated as financial instruments |

Subject to EU payment services regulations |

Non-compliance with AML and KYC, disputes regarding transaction processing |

| China |

Strict regulatory restrictions |

Limited or prohibited access to crypto services |

Criminal penalties for illicit cryptocurrency activity |

| Japan |

Generally, a more permissive approach |

Subject to financial regulations for payment services |

Money laundering, violations of KYC |

Customer Support and User Experience

Navigating the world of cryptocurrency can be daunting, especially when making purchases. Reliable customer support and a seamless user experience are crucial for building trust and ensuring a smooth transaction process. This section delves into the various support channels available, the overall user experience, potential issues, and how to address them.

Types of Customer Support Offered

Different cryptocurrency platforms offer various customer support options to assist users. These channels range from readily available live chat to more formal email communication. A well-rounded support system is key to addressing user queries promptly and effectively.

- Live Chat: Many platforms utilize live chat as a primary support channel, offering real-time assistance. This immediate response can resolve issues quickly and provide tailored guidance. Live chat is often the fastest way to obtain help, but response times may vary based on platform traffic.

- Email Support: Email remains a common method for detailed support inquiries. This channel is particularly useful for complex issues or when users need a written record of their interaction.

- Phone Support: Some platforms offer phone support, which can be beneficial for users needing personalized guidance or immediate assistance. This channel provides a more direct and personalized interaction, potentially resolving issues faster.

- Social Media Support: Platforms increasingly use social media channels like Twitter for customer service. This can provide quick updates and general support, but might not be the best choice for complex or sensitive issues.

User Experience Evaluation

The user experience (UX) of buying crypto with credit cards varies significantly between platforms. Factors like ease of navigation, clarity of instructions, and the overall design contribute to the overall user experience. A positive UX encourages repeat customers and builds confidence in the platform.

- Navigation and Interface: A well-structured platform with clear navigation helps users quickly locate necessary information and complete transactions without confusion. Intuitive design simplifies the process and minimizes errors.

- Transaction Clarity: The platform should clearly display all transaction details, including fees, amounts, and confirmation steps. Transparency builds user trust and allows for easy monitoring of the transaction process.

- Security Measures: Users should be assured of robust security measures, such as encryption and two-factor authentication. Confidence in the platform’s security directly impacts the user experience.

Common Issues and Resolution

Several issues can arise during the crypto purchase process. Addressing these issues promptly is crucial for maintaining a positive user experience.

- Transaction Failures: If a transaction fails, users should check for technical errors, insufficient funds, or credit card issues. Reviewing the platform’s error messages and contacting support can help resolve the problem.

- Incorrect Information Input: Mistakes in inputting details, such as email addresses or account numbers, can lead to issues. Carefully double-checking information before submitting is essential.

- Security Concerns: If a user suspects fraudulent activity or has concerns about security, immediate contact with the platform’s support is critical. Following the platform’s security guidelines is important to mitigate risks.

Customer Support Comparison Table

This table provides a brief comparison of support options for various crypto exchange platforms. The table shows the availability of different support channels, offering users a clearer view of their options.

| Platform |

Phone Support |

Email Support |

Live Chat |

Social Media |

| Platform A |

Yes |

Yes |

Yes |

Yes |

| Platform B |

No |

Yes |

Yes |

Yes |

| Platform C |

Yes |

Yes |

No |

Yes |

Alternatives to Credit Cards

Purchasing cryptocurrencies doesn’t necessitate using a credit card. Numerous alternative payment methods offer varying degrees of convenience, security, and cost. Understanding these alternatives is crucial for making informed decisions about your crypto purchases.

Overview of Alternative Payment Methods

Alternative payment methods for crypto purchases encompass a range of options, each with its own characteristics. These alternatives provide flexibility and often come with advantages beyond those offered by credit cards. Choosing the right method depends on individual priorities and circumstances.

Bank Transfers

Bank transfers, such as wire transfers or ACH transactions, are a common method for moving funds between bank accounts. These methods often allow for larger transactions and are frequently used for purchasing cryptocurrencies. A significant advantage is the potential for lower transaction fees compared to credit cards. However, the transaction speed can be slower, potentially taking several business days.

Debit Cards

Debit cards enable direct withdrawals from a bank account to fund crypto purchases. This method is generally faster than bank transfers and often more convenient than credit cards. Debit cards offer a familiar user experience, making them readily accessible to users. However, fees can still be applied, although often less than credit card fees. Additionally, some platforms might limit the transaction amount per day or per month.

Peer-to-Peer (P2P) Exchanges

P2P exchanges facilitate transactions between individual users. This method often offers the potential for lower transaction fees and increased flexibility in terms of payment methods. However, the security of the transaction rests on the reliability and trustworthiness of the individuals involved. P2P exchanges can be convenient for smaller transactions and direct interactions but might present risks not present with other methods.

Comparison of Payment Methods

| Payment Method |

Transaction Speed |

Cost |

Security |

Convenience |

| Bank Transfers |

Slow (Several business days) |

Potentially Low |

Generally High |

Moderate |

| Debit Cards |

Fast (Instant or near-instant) |

Moderate |

Moderate |

High |

| P2P Exchanges |

Variable (Dependent on the exchange) |

Potentially Low |

Moderate to Low (depending on platform and user) |

Variable (Dependent on the exchange) |

The table highlights the key differences between various payment methods for crypto purchases. Transaction speed, cost, and security are crucial factors to consider when choosing a method. Factors like the user’s comfort level and the nature of the transaction can also influence the best choice.

Wrap-Up

In conclusion, buying crypto using credit cards presents a viable option for accessing the cryptocurrency market. While convenience is a key factor, understanding the associated fees, security protocols, and regulatory landscape is essential. This guide has provided a thorough overview, empowering you to navigate the process confidently and securely.

Question & Answer Hub

What are the typical fees associated with buying crypto using a credit card?

Fees vary significantly depending on the platform. Some platforms charge a percentage of the transaction, while others may add a flat fee. It’s crucial to review the specific fees on each platform before making a purchase.

Are there any security risks involved when buying crypto with a credit card?

Yes, as with any online transaction, security is paramount. Choose reputable platforms with robust security measures. Always double-check the legitimacy of the platform before entering your credit card information. Using strong passwords and enabling two-factor authentication adds another layer of protection.

What are some alternative payment methods for buying crypto besides credit cards?

Alternative methods include bank transfers, debit cards, and peer-to-peer exchanges. Each method has its own advantages and disadvantages regarding cost, speed, and security. Bank transfers tend to be slower but often cheaper, while debit cards offer a familiar experience.

How do I verify the legitimacy of a cryptocurrency exchange platform?

Research the platform thoroughly. Look for reputable reviews and see if the platform is regulated by any financial authorities. Check for clear terms and conditions and customer support contact information. If the platform is new or unfamiliar, exercise caution.