Looking to dive into the world of cryptocurrency? Luno offers a gateway to buying Bitcoin and other cryptocurrencies. This guide provides a detailed overview, covering everything from account creation to security best practices. We’ll explore the ins and outs of Luno’s platform, compare it to other exchanges, and delve into the fundamentals of Bitcoin and cryptocurrency investments.

From understanding different account types to navigating the complexities of various cryptocurrencies, we’ll equip you with the knowledge needed to make informed decisions. This comprehensive guide will walk you through the process of purchasing Bitcoin on Luno, highlighting essential security measures and providing a clear roadmap for success in this dynamic market.

Introduction to Luno and Bitcoin Trading

Luno, a prominent cryptocurrency exchange, has carved a niche for itself in the global digital asset landscape. Founded in 2013, it has played a significant role in making Bitcoin and other cryptocurrencies more accessible to users around the world. Its user-friendly platform and commitment to security have attracted a large user base, particularly in regions where traditional financial services might be less readily available.Luno’s platform offers a comprehensive suite of features tailored for both novice and experienced cryptocurrency traders.

From simple Bitcoin purchases to complex trading strategies, the platform accommodates various needs. Luno’s focus on security and regulatory compliance ensures a secure environment for users to engage in their financial transactions.

Luno’s History and Role in the Cryptocurrency Market

Luno’s history is intertwined with the evolution of the cryptocurrency market. Its early presence helped establish a foothold for digital assets in emerging markets. This early adoption and pioneering efforts have positioned Luno as a trusted and established player in the cryptocurrency space.

Features and Benefits of Using Luno

Luno’s platform provides a range of features designed to enhance the user experience and facilitate smooth trading operations. These features contribute to a positive and user-friendly environment. Security measures are paramount, employing industry-standard protocols to safeguard user funds.

- User-Friendly Interface: Luno’s intuitive platform simplifies the process of buying, selling, and managing cryptocurrency holdings. This accessibility is a key benefit for both novice and experienced users.

- Competitive Fees: Luno offers competitive trading fees, aiming to provide users with cost-effective transactions.

- Multiple Payment Options: Luno supports a variety of payment methods, catering to users from different regions and financial backgrounds. This versatility enhances the user experience by offering choices.

- 24/7 Customer Support: Round-the-clock customer support is available to address user queries and concerns promptly, thereby enhancing the overall user experience.

Account Types Offered by Luno

Luno provides various account types to accommodate diverse user needs and financial situations. Each account type offers a unique set of features and benefits.

- Standard Account: This is the most basic account type, suitable for users who are just starting their cryptocurrency journey. It often includes essential features for beginners, such as limited trading volumes and fewer advanced options.

- Premium Account: A premium account offers enhanced features and benefits, including higher trading limits, priority customer support, and potentially lower fees for high-volume traders. It’s tailored for users who actively trade larger amounts of cryptocurrency.

Comparison of Luno to Other Major Exchanges

This table Artikels a comparative analysis of Luno’s features relative to other prominent cryptocurrency exchanges. The table considers key factors such as fees, security, and offered features.

| Platform | Fees | Security | Features |

|---|---|---|---|

| Luno | Competitive, tiered fee structure. | Industry-standard security measures, including two-factor authentication. | User-friendly interface, multiple payment methods, and 24/7 customer support. |

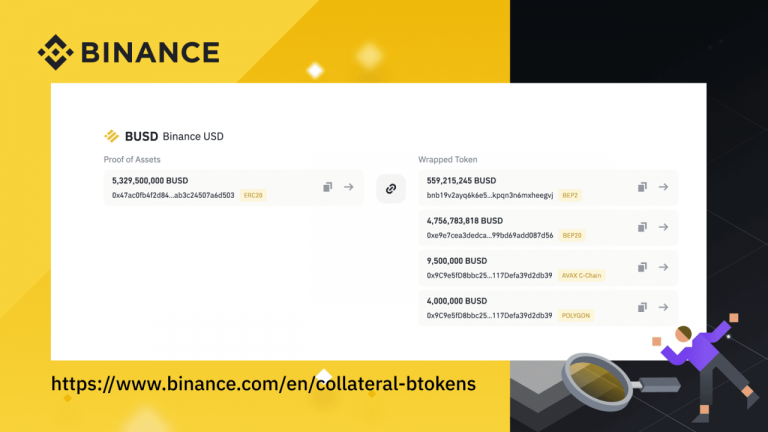

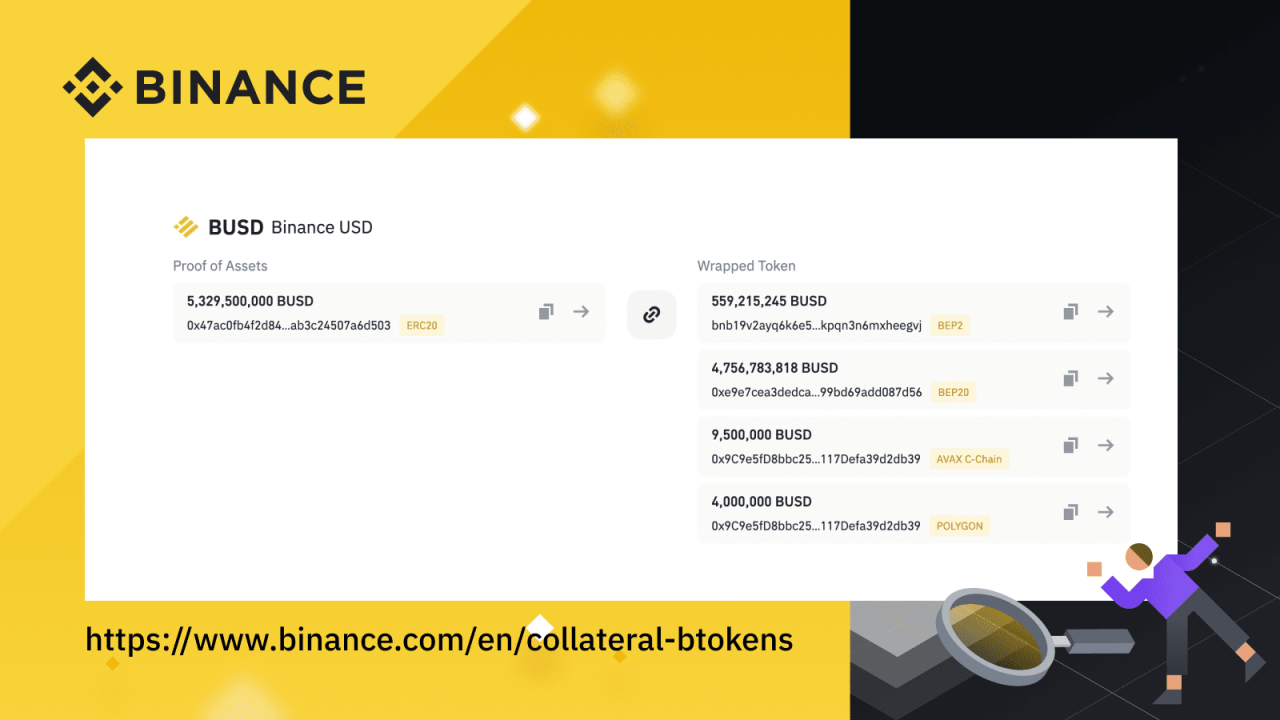

| Binance | Variable fees based on trading volume. | Robust security measures, including cold storage and multi-signature wallets. | Extensive trading options, large market capitalization, and a vast selection of cryptocurrencies. |

| Coinbase | Fixed or tiered fees. | Strong security protocols, incorporating advanced security measures. | User-friendly interface, simple deposit and withdrawal methods, and regulatory compliance. |

| Kraken | Variable fees, tiered fee structure. | High level of security, including multi-factor authentication and advanced security measures. | Advanced trading options, high liquidity, and a wide range of supported cryptocurrencies. |

Understanding Bitcoin and Cryptocurrency

Bitcoin and other cryptocurrencies have rapidly gained popularity, offering an alternative to traditional financial systems. This section delves into the fundamental concepts, risks, and diverse types of cryptocurrencies, providing a comprehensive overview for potential investors.Bitcoin, the pioneering cryptocurrency, operates on a decentralized network using blockchain technology. This technology records and verifies transactions across a distributed ledger, enhancing security and transparency.

Its value proposition lies in its potential for global transactions without intermediaries, reduced transaction fees, and the possibility of higher returns compared to traditional investments.

Fundamental Concepts of Bitcoin

Bitcoin’s core concept rests on the blockchain, a secure and transparent digital ledger. Transactions are verified and added to the blockchain in blocks, creating a permanent and immutable record. This decentralization removes the need for intermediaries, enabling peer-to-peer transactions. Bitcoin’s value is determined by market forces, supply and demand, and public perception. A key aspect is its limited supply, with a maximum of 21 million Bitcoins.

Bitcoin’s Underlying Technology

Bitcoin’s underlying technology, the blockchain, uses cryptography to secure transactions and prevent fraud. Transactions are grouped into blocks, which are then chained together to form a permanent record. Proof-of-work is a critical mechanism in Bitcoin’s security model, requiring computational power to validate transactions and add new blocks to the chain. This process ensures the integrity and security of the network.

Risks Associated with Cryptocurrency Investments

Investing in Bitcoin and other cryptocurrencies carries inherent risks. Volatility is a significant concern, with prices fluctuating dramatically over short periods. Regulatory uncertainty and market manipulation can also impact cryptocurrency values. Security risks, including hacking and scams, are also present. A lack of established regulatory frameworks in many jurisdictions also contributes to the inherent risks.

Different Types of Cryptocurrencies

Beyond Bitcoin, numerous other cryptocurrencies exist, each with its unique characteristics and use cases. These include altcoins, which often target specific niche applications or address perceived limitations of Bitcoin. Different types of cryptocurrencies leverage varying underlying technologies and consensus mechanisms. For example, some utilize proof-of-stake instead of proof-of-work, offering potentially lower energy consumption.

Cryptocurrency Use Cases

| Cryptocurrency | Use Case | Advantages | Disadvantages |

|---|---|---|---|

| Bitcoin (BTC) | Global peer-to-peer transactions, remittances, and diversifying investment portfolios. | Decentralized, transparent, and low transaction fees compared to traditional systems in some cases. | High volatility, limited functionality beyond basic transactions. |

| Ethereum (ETH) | Smart contract development, decentralized applications (dApps), and tokenized assets. | Facilitates a broad range of applications, supports diverse use cases. | Complexity in understanding the technology, relatively higher transaction costs compared to Bitcoin in some cases. |

| Tether (USDT) | Stablecoin pegged to the US dollar, facilitating cryptocurrency trading and hedging. | Provides price stability, enabling easier integration with traditional financial systems. | Susceptibility to manipulation, potential for instability if the peg is broken. |

| Dogecoin (DOGE) | Meme-based cryptocurrency, used for novelty and sometimes for microtransactions. | High accessibility and potential for social media buzz. | Limited functionality, extremely volatile, often associated with speculation rather than significant utility. |

Buying Bitcoin on Luno

Getting started with Bitcoin on Luno is straightforward. This guide will walk you through the essential steps, from account creation to monitoring your holdings. Understanding the process empowers you to confidently navigate the platform and manage your Bitcoin investments effectively.The Luno platform offers a secure and user-friendly environment for buying and selling Bitcoin and other cryptocurrencies. It’s crucial to understand the steps involved in account creation and verification, as well as the different order types and payment methods available.

This ensures a smooth and safe trading experience.

Creating a Luno Account and Verification

Setting up a Luno account involves providing necessary personal information. Accurate and complete information is vital for verification. This process is designed to protect your account and comply with regulations.

- Register: Visit the Luno website and click on the “Sign Up” button. Fill in the required fields with accurate personal details, including your email address and desired password. Review the platform’s terms and conditions and confirm your agreement.

- Verification: Luno requires verification to ensure compliance with KYC (Know Your Customer) regulations. This step involves submitting documents to verify your identity, typically a valid government-issued photo ID and proof of address. These documents must be clearly visible and in good condition.

- Account Activation: Once your verification is complete, your Luno account is activated. You can now access the platform and start exploring trading options.

Purchasing Bitcoin on Luno

Luno allows various payment methods for Bitcoin purchases. Transaction fees apply and vary based on the chosen payment method and the amount transacted. Familiarize yourself with the fees to optimize your transactions.

- Payment Methods: Luno supports a range of payment methods for buying Bitcoin, including bank transfers, credit/debit cards, and others. Each method might have different transaction limits and associated fees.

- Transaction Fees: Luno charges transaction fees on Bitcoin purchases. These fees can be displayed and reviewed before confirming a transaction. The exact amount may depend on several factors, such as the chosen payment method and the volume of the transaction.

- Order Types: Different order types allow you to specify how you want to buy Bitcoin. Market orders execute immediately at the current market price. Limit orders let you set a desired price, and if the price reaches it, the order is filled.

Order Types for Bitcoin Purchases

Understanding the different order types available is key to managing your Bitcoin purchases. Each type has its own implications for price and execution.

- Market Orders: Market orders execute immediately at the prevailing market price. This is the fastest way to buy Bitcoin, but you might not get the best possible price.

- Limit Orders: Limit orders allow you to set a desired price for your Bitcoin purchase. If the price reaches your limit, the order is filled. This can ensure you buy at a specific price but might not result in an immediate purchase.

Monitoring Bitcoin Holdings and Transactions

Tracking your Bitcoin holdings and transactions on Luno provides a clear picture of your investments. Luno’s platform allows you to monitor your portfolio, view transaction history, and manage your assets effectively.

- Transaction History: The Luno platform offers detailed transaction history. This enables you to review past transactions, including the date, time, quantity, price, and payment method used.

- Portfolio Overview: Luno’s platform displays a comprehensive overview of your Bitcoin holdings. This view includes your current balance, value, and transaction history.

Step-by-Step Guide to Buying Bitcoin on Luno

This structured guide simplifies the Bitcoin purchase process on Luno.

- Create a Luno account and verify your identity. Complete the required steps to ensure your account is verified.

- Fund your Luno account with your chosen payment method. Deposit the necessary funds.

- Locate the Bitcoin trading section on the Luno platform. Navigate to the appropriate section for Bitcoin transactions.

- Select the desired order type (e.g., market or limit order). Choose the type of order that suits your investment strategy.

- Specify the quantity of Bitcoin you wish to purchase. Enter the amount of Bitcoin you want to buy.

- Review the transaction details, including the price, fees, and total cost. Carefully examine all details before confirming the transaction.

- Confirm the transaction. Once you’re satisfied with the details, confirm the purchase.

- Monitor your Bitcoin holdings and transactions on the Luno platform. Review your portfolio and transaction history to keep track of your investment.

Security and Safety on Luno

Luno prioritizes the security of its users’ funds and accounts. Robust security measures are in place to protect against various threats, including cyberattacks and fraudulent activities. This section details Luno’s security protocols and offers advice on how to maintain a secure Luno account.

Luno’s Security Measures

Luno employs a multi-layered approach to security, incorporating advanced technologies and procedures to safeguard user assets. These measures are constantly reviewed and updated to adapt to evolving threats in the cryptocurrency landscape.

| Measure | Description | Benefits | Drawbacks |

|---|---|---|---|

| Two-Factor Authentication (2FA) | Requires a second verification method (e.g., a code sent to your phone) beyond your password to access your account. | Significantly increases account security by adding an extra layer of protection against unauthorized access. | Requires a functioning phone and may present a slight inconvenience for users who are not comfortable with 2FA. |

| Secure Hardware Wallets | Luno employs secure hardware wallets to store private keys offline, making them resistant to online hacking attempts. | Provides an extremely secure method for safeguarding sensitive cryptographic keys. | May require additional technical knowledge for users to utilize the hardware wallets. |

| Regular Security Audits | Luno undergoes rigorous security audits from independent third-party firms. | Ensures adherence to best security practices and identification of potential vulnerabilities. | Audits may be expensive and require time, although this is crucial for long-term security. |

| Advanced Encryption | Uses strong encryption protocols to protect data transmitted between users and Luno’s servers. | Protects user data from unauthorized interception during transmission. | Requires constant updates and maintenance to stay current with evolving encryption threats. |

Protecting Your Luno Account and Crypto

Maintaining a secure Luno account is crucial for safeguarding your cryptocurrency holdings. Following best practices can significantly reduce the risk of compromise.

- Strong Passwords: Create strong, unique passwords for your Luno account and other online accounts. Avoid using easily guessed passwords.

- Regular Account Monitoring: Regularly review your account activity and transactions to detect any suspicious activity promptly.

- Avoid Phishing Scams: Be wary of unsolicited emails or messages asking for your login credentials or private keys. Legitimate companies will never ask for this information via email or SMS.

- Safe Storage of Private Keys: Never share your private keys with anyone. Storing them securely, preferably offline, is essential to prevent theft.

Importance of Safe Private Keys

Your private keys are the keys to accessing your cryptocurrency holdings. Losing or compromising these keys can result in the permanent loss of your assets. Safeguarding your private keys is paramount.

Cryptocurrency Scams and Fraud

Be cautious of fraudulent activities and scams targeting cryptocurrency traders. Common tactics include phishing emails, fake investment schemes, and pump-and-dump schemes.

“Verify the legitimacy of any investment opportunity before committing your funds. Do thorough research and consult with financial professionals if needed.”

Buying Bitcoin (General)

Purchasing Bitcoin, like any other investment, involves careful consideration of available methods and potential risks. Understanding the diverse options and the inherent volatility of the market is crucial for making informed decisions. This section explores various avenues for acquiring Bitcoin, factors influencing platform selection, and the general process, emphasizing the importance of responsible investment practices.

Comparison of Bitcoin Acquisition Methods

Different methods exist for acquiring Bitcoin, each with its own set of characteristics. Exchanges, often favoured for their accessibility and liquidity, provide a platform for buying and selling Bitcoin using fiat currency (like USD or EUR). Over-the-counter (OTC) markets, on the other hand, facilitate transactions between individuals or institutions, offering greater flexibility but potentially higher risks due to a lack of regulatory oversight.

The choice between these methods depends on individual needs and risk tolerance.

Factors to Consider When Choosing a Platform

Several key factors should be considered when selecting a platform for buying Bitcoin. Security measures, including encryption protocols and cold storage solutions, are paramount. Fees charged for transactions, including trading fees and withdrawal fees, should be assessed to ensure they are reasonable and transparent. Platform usability and customer support are also crucial aspects for a seamless experience.

The platform’s regulatory compliance and licensing status are critical indicators of its trustworthiness and adherence to industry standards.

General Bitcoin Purchase Process Overview

The general process for buying Bitcoin, regardless of the platform, typically involves these steps:

- Account Creation: A user account needs to be established on the chosen platform, which may involve providing personal information and verifying identity to comply with regulations.

- Funding the Account: Funds need to be deposited into the account, often through bank transfers or other secure methods. Ensure the platform is compliant with local regulations regarding funding sources.

- Placing an Order: A buy order for Bitcoin is placed at the desired price and quantity. This might involve using limit orders or market orders.

- Verification and Confirmation: The platform will verify the order and, if successful, confirm the transaction. Confirmation times may vary based on the platform and transaction volume.

- Bitcoin Delivery: Upon successful completion of the transaction, the purchased Bitcoin will be credited to the user’s wallet, and the funds will be debited from the account.

Market Volatility and Potential Losses

Bitcoin prices are susceptible to significant fluctuations, influenced by various market forces. This volatility can lead to substantial gains or losses. Understanding the market dynamics, including news events, regulatory changes, and technological advancements, is crucial for assessing potential risks. Thorough research and diversification of investment strategies are recommended. Historical data and expert analysis can provide insights into market trends, but predictions are inherently uncertain.

Flowchart of Bitcoin Purchase

This flowchart illustrates the general steps for purchasing Bitcoin.“`[Start] –> [Choose Platform] –> [Account Creation] –> [Funding Account] –> [Place Order] –> [Verification & Confirmation] –> [Bitcoin Delivery] –> [End]“`

Additional Services and Features on Luno

Luno offers a suite of services beyond Bitcoin trading, catering to a broader range of cryptocurrency investments. Understanding these additional features is crucial for making informed decisions about your crypto portfolio. This section explores Luno’s ecosystem, from trading other cryptocurrencies to transferring assets and utilizing fiat currency.

Trading Other Cryptocurrencies

Luno’s platform facilitates trading in various cryptocurrencies, allowing users to diversify their portfolios. This broader selection expands investment options beyond Bitcoin, enabling exposure to different market trends and potential returns. Users can explore and compare various crypto assets to make informed decisions about their investments.

Unique Features of Luno’s Platform

Luno distinguishes itself through several platform-specific features. These features aim to enhance the user experience and offer added security and convenience. One notable feature is the user-friendly interface, designed to make navigating the platform intuitive and accessible. Another key aspect is the robust security measures implemented to protect user funds and data.

Transferring Bitcoin Between Luno and Other Wallets

Luno provides secure methods for transferring Bitcoin to and from other digital wallets. The process typically involves generating a Bitcoin address and entering the destination address for the transfer. Luno’s platform guides users through this process with clear instructions and prompts. This flexibility enables users to move their Bitcoin holdings between different platforms or personal wallets as needed.

The Role of Fiat Currency in Bitcoin Transactions

Fiat currency, such as USD or EUR, plays a critical role in Bitcoin transactions on Luno. Users often need to deposit fiat currency into their Luno account to purchase Bitcoin or other cryptocurrencies. This enables the conversion of fiat into cryptocurrency and vice-versa. The integration of fiat currency allows for seamless access to the cryptocurrency market.

Comparing Luno Features

| Feature | Description | Advantages | Disadvantages |

|---|---|---|---|

| Trading Other Cryptocurrencies | Allows users to trade a variety of cryptocurrencies beyond Bitcoin. | Expanded investment opportunities, diversification potential. | Potential for increased complexity, managing diverse market trends. |

| User-Friendly Interface | Intuitive platform design for easy navigation. | Simplified trading experience, accessibility for new users. | May not cater to advanced users requiring extensive customization options. |

| Robust Security Measures | High-level security protocols to protect user funds. | Enhanced safety and security, user trust. | Potential for slightly more complex setup compared to less secure platforms. |

| Fiat Currency Integration | Allows seamless conversion between fiat and cryptocurrency. | Convenience of using familiar currency, wider accessibility. | Potential for fluctuations in exchange rates impacting profit/loss. |

Luno and Bitcoin: Market Trends

Bitcoin and cryptocurrency markets are dynamic environments, subject to constant fluctuations. Understanding these trends is crucial for informed investment decisions. Recent market activity has been influenced by a complex interplay of factors, including regulatory shifts, technological advancements, and global economic conditions. Luno, as a prominent cryptocurrency exchange, is directly affected by these market forces.

Recent Market Trends Affecting Bitcoin and Cryptocurrency Prices

Recent trends in the Bitcoin and cryptocurrency markets showcase a complex interplay of factors. Volatility remains a defining characteristic, with prices exhibiting significant fluctuations. These price swings are often driven by news events, regulatory announcements, and shifts in investor sentiment. For example, the recent increase in interest rates by central banks globally has often impacted the price of Bitcoin, as investors look for alternative investment opportunities.

Factors Influencing Bitcoin Price Fluctuations

Numerous factors contribute to the fluctuating nature of Bitcoin’s price. Market sentiment plays a significant role, with investor confidence and fear impacting supply and demand. News events, both positive and negative, can trigger sudden price movements. Technological advancements, such as the development of new blockchain applications, can either boost or depress investor interest. Government regulations and policies, especially those concerning cryptocurrency, are major determinants of the market’s direction.

Impact of Regulatory Changes on Luno and the Bitcoin Market

Regulatory changes worldwide have a direct impact on cryptocurrency exchanges like Luno and the Bitcoin market as a whole. Stricter regulations can increase compliance costs for exchanges, potentially affecting their operations. Conversely, favorable regulations can stimulate market growth and attract more investors. Luno, as a regulated exchange, must adapt to regulatory environments, maintaining compliance and fostering trust. Examples of how different regulatory frameworks in various countries have impacted the Bitcoin market can be seen in the different regulations around taxation and KYC/AML policies.

Future Prospects for Luno and Bitcoin

Predicting the future of Bitcoin and Luno involves assessing multiple potential scenarios. Continued technological advancements, such as advancements in blockchain technology and the development of decentralized finance (DeFi) applications, could significantly impact Bitcoin’s future. The evolution of regulatory frameworks across different jurisdictions will also play a critical role. The adoption of Bitcoin and cryptocurrencies by mainstream financial institutions could further propel their development.

While these advancements are potential factors, no one can definitively predict the exact path of the market.

Bitcoin Price Trends Over the Past Year (Illustrative Example)

| Date | Bitcoin Price (USD) |

|---|---|

| January 1, 2023 | $23,000 |

| April 1, 2023 | $30,000 |

| July 1, 2023 | $28,000 |

| October 1, 2023 | $25,000 |

| December 31, 2023 | $27,500 |

This table presents a hypothetical illustration of Bitcoin’s price fluctuations over the past year. Actual price data should be consulted from reputable sources for precise information. A visual representation, like a line graph, would further clarify the trend.

Final Thoughts

In conclusion, buying Bitcoin and other cryptocurrencies on Luno involves understanding the platform’s features, security measures, and market trends. This guide provided a comprehensive overview, enabling you to navigate the process with confidence. By understanding the potential risks and rewards, you can make informed decisions and potentially profit from this innovative financial landscape. Remember to prioritize security and conduct thorough research before investing.

FAQs

What are the different account types offered by Luno?

Luno offers various account types catering to different needs. Basic accounts are suitable for beginners, while premium accounts may offer more features and potentially lower fees. Each account type comes with varying benefits and limitations.

What are the risks associated with cryptocurrency investments?

Cryptocurrency investments come with inherent risks. Market volatility, security concerns, and regulatory uncertainty are key factors to consider before entering this market. Thorough research and diversification are crucial.

How do I keep my Luno account and cryptocurrency holdings secure?

Following Luno’s security guidelines and best practices is crucial. Safeguarding your private keys and being aware of scams are vital steps in protecting your investments. Consider using strong passwords and enabling two-factor authentication.

What are the different payment methods for purchasing Bitcoin on Luno?

Luno supports various payment methods for buying Bitcoin. These may include bank transfers, credit/debit cards, and other digital payment options. Check Luno’s website for the most up-to-date list of supported methods.